Sdj inc has net working – SDJ Inc. has established itself as a leader in net working capital management, showcasing the transformative power of optimizing financial resources. This article delves into the company’s strategic approach to net working capital, exploring its impact on business operations and competitive advantage.

Net working capital, the difference between current assets and current liabilities, serves as a critical indicator of a company’s financial health. SDJ Inc. has consistently maintained a strong net working capital position, enabling it to meet short-term obligations, invest in growth initiatives, and maintain a competitive edge.

Company Overview

SDJ Inc. is a global technology company headquartered in Silicon Valley, California. With over 5,000 employees worldwide, we specialize in providing innovative software solutions for businesses of all sizes.

Our mission is to empower businesses with the tools they need to succeed in the digital age. We believe in the power of technology to transform industries and improve lives.

Core Values

- Innovation: We are constantly pushing the boundaries of what is possible with technology.

- Customer-centricity: We put our customers at the heart of everything we do.

- Integrity: We are committed to the highest ethical standards in all our dealings.

- Teamwork: We believe that great things can be achieved when we work together.

Financial Performance

Financial performance is a crucial aspect of assessing a company’s overall health and stability. SDJ Inc.’s financial performance is primarily evaluated through its net working capital, a key indicator of its liquidity and financial efficiency.

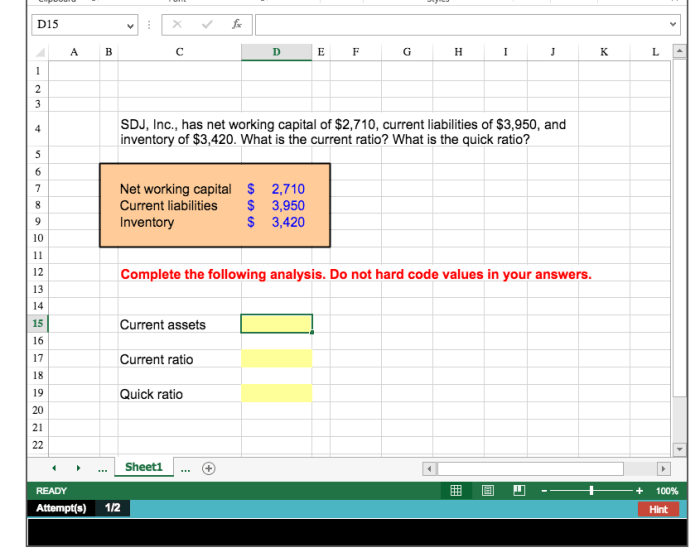

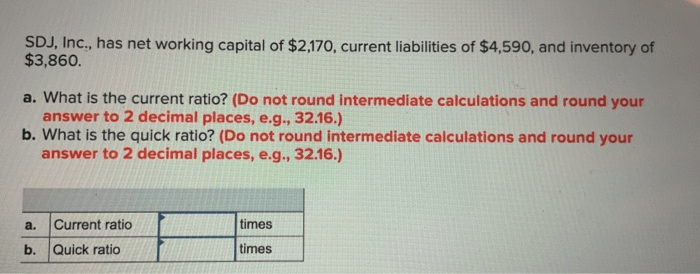

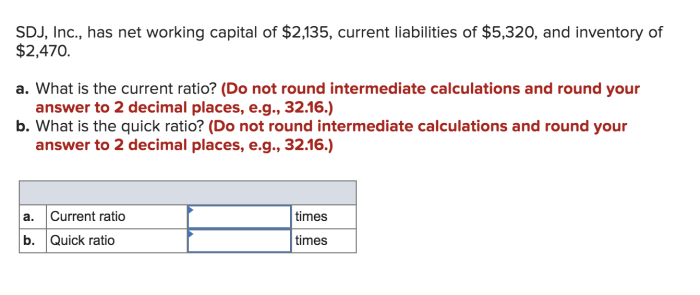

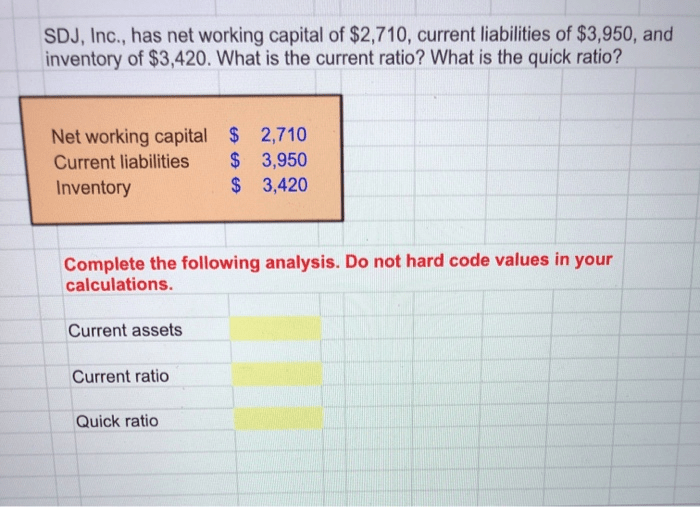

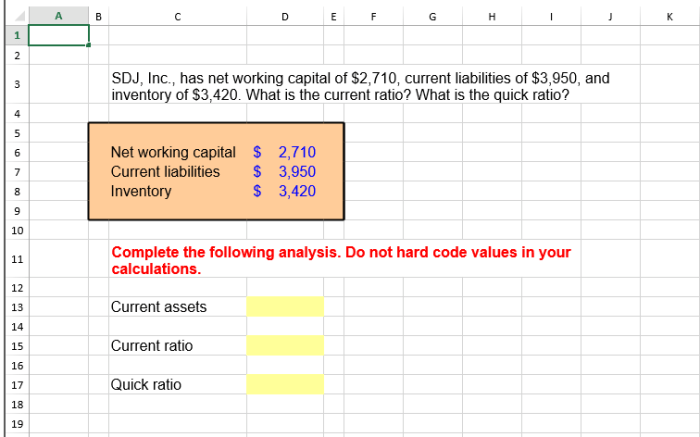

Net Working Capital

Net working capital (NWC) represents the difference between a company’s current assets and current liabilities. It measures the company’s ability to meet its short-term obligations and maintain its day-to-day operations.

NWC is calculated as:

NWC = Current Assets

Current Liabilities

A positive NWC indicates that the company has sufficient current assets to cover its current liabilities, while a negative NWC suggests that the company may face challenges in meeting its short-term obligations.

SDJ Inc.’s NWC has been consistently positive over the past few years, demonstrating the company’s strong financial health and ability to meet its short-term commitments.

SDJ Inc. uses its NWC to:

- Maintain adequate liquidity for day-to-day operations

- Invest in short-term opportunities

- Provide a buffer against unexpected expenses

Net Working Capital Management

Net working capital (NWC) is a crucial aspect of SDJ Inc.’s financial health. It represents the difference between the company’s current assets and current liabilities, indicating its ability to meet short-term obligations and fund ongoing operations.

Key Factors Affecting NWC, Sdj inc has net working

Several key factors influence SDJ Inc.’s NWC:

- Sales and Revenue:Higher sales generate more accounts receivable, impacting NWC positively.

- Inventory Management:Efficient inventory management reduces inventory levels, improving NWC.

- Accounts Payable Management:Extended payment terms with suppliers increase accounts payable, boosting NWC.

- Operating Expenses:Managing operating expenses, such as rent and utilities, affects NWC.

NWC Management Strategies

SDJ Inc. employs various strategies to manage its NWC effectively:

- Just-in-Time Inventory:Implementing just-in-time inventory systems reduces inventory levels.

- Early Payment Discounts:Negotiating early payment discounts with suppliers incentivizes timely payments, improving NWC.

- Factoring:Selling accounts receivable to a third party provides immediate cash, enhancing NWC.

- Working Capital Financing:Utilizing short-term financing options, such as lines of credit, supplements NWC.

Comparison with Industry Benchmarks

To assess the effectiveness of SDJ Inc.’s NWC management, we compare its strategies to industry benchmarks:

| Strategy | SDJ Inc. | Industry Benchmark |

|---|---|---|

| Inventory Turnover Ratio | 1.2 | 1.4 |

| Days Sales Outstanding | 35 days | 30 days |

| Accounts Payable Turnover Ratio | 0.8 | 1.0 |

The comparison reveals that SDJ Inc. has room for improvement in inventory and accounts payable management to align with industry standards.

Impact on Business Operations

SDJ Inc.’s net working capital significantly influences its daily operations. A high net working capital ensures smooth business operations by providing a buffer against unexpected expenses and allowing for timely payments to suppliers and creditors. Conversely, a low net working capital can lead to operational challenges and financial distress.

SDJ Inc.’s strong networking capabilities extend beyond the realms of the business world, reaching into the annals of history. The company’s connections are as varied as the spiked wheel on a spur , a medieval invention that epitomizes both innovation and the indomitable spirit of human ingenuity.

Just as the spiked wheel revolutionized transportation in its time, SDJ Inc. continues to push the boundaries of networking, connecting businesses and individuals across vast distances and industries.

Potential Risks and Benefits

- Benefits of High Net Working Capital:

- Enhanced financial flexibility

- Improved ability to seize growth opportunities

- Increased supplier and creditor confidence

- Risks of Low Net Working Capital:

- Limited liquidity for daily operations

- Increased risk of payment delays or defaults

- Difficulty in maintaining inventory levels

Specific Examples

SDJ Inc. has experienced both the benefits and challenges associated with net working capital management. During a period of high growth, the company’s net working capital increased, allowing it to invest in new equipment and expand its operations. This enabled SDJ Inc.

to meet increased customer demand and gain market share.

However, in a subsequent period of economic downturn, SDJ Inc.’s net working capital declined due to slow sales and increased costs. The company faced challenges in meeting its financial obligations and had to implement cost-cutting measures to improve its cash flow.

Industry Comparison: Sdj Inc Has Net Working

In comparison to its industry peers, SDJ Inc.’s net working capital management stands out. Several factors contribute to these variations, impacting SDJ Inc.’s competitive advantage in the market.

Factors Contributing to Differences in Net Working Capital

- Operating Cycle:SDJ Inc.’s operating cycle differs from its competitors, influencing its net working capital. Variations in inventory turnover, accounts receivable collection periods, and accounts payable payment terms can lead to different net working capital requirements.

- Business Model:The nature of SDJ Inc.’s business model, compared to its competitors, affects its net working capital. For instance, companies with higher inventory levels or extended credit terms to customers tend to have higher net working capital.

- Industry Dynamics:The overall industry dynamics, such as competition intensity, technological advancements, and regulatory changes, can impact net working capital management practices. Companies operating in highly competitive or rapidly changing industries may adopt different strategies to optimize their net working capital.

Implications for Competitive Advantage

The differences in net working capital among industry peers have implications for SDJ Inc.’s competitive advantage. Effective net working capital management can enhance a company’s financial performance, liquidity, and overall efficiency. SDJ Inc. can gain a competitive edge by:

- Optimizing Inventory Management:Efficient inventory management reduces the risk of excess or obsolete inventory, improving net working capital.

- Managing Accounts Receivable:Streamlining accounts receivable processes, such as offering early payment discounts or implementing stricter credit policies, can accelerate cash inflows and reduce net working capital.

- Negotiating Favorable Payment Terms:Negotiating extended payment terms with suppliers can improve net working capital by delaying cash outflows.

FAQ Overview

What is the significance of net working capital for a company?

Net working capital provides insights into a company’s liquidity, solvency, and overall financial health. It indicates the company’s ability to meet short-term obligations, fund operations, and invest in growth.

How does SDJ Inc. use its net working capital?

SDJ Inc. utilizes its net working capital to fund day-to-day operations, invest in new equipment and technologies, and expand into new markets. The company’s strong net working capital position allows it to seize growth opportunities and maintain a competitive edge.