Dexter company uses the direct write-off method – The direct write-off method, employed by Dexter Company, stands as a crucial accounting technique for managing uncollectible accounts. This method involves recognizing bad debts as expenses only when specific criteria are met, providing a clear understanding of its advantages, disadvantages, and accounting treatment.

Dexter Company’s utilization of the direct write-off method aligns with its specific circumstances, ensuring accurate financial reporting and effective management of uncollectible accounts.

Dexter Company’s Direct Write-Off Method

The direct write-off method is an accounting technique used to record uncollectible accounts as expenses when they become uncollectible. Dexter Company uses the direct write-off method because it is a simple and inexpensive method to implement. Additionally, Dexter Company believes that the direct write-off method provides a more accurate representation of its financial position than the allowance method.

Specific Circumstances, Dexter company uses the direct write-off method

Dexter Company uses the direct write-off method in the following circumstances:

- When a customer’s account has been outstanding for a period of time and the company has exhausted all reasonable collection efforts.

- When a customer declares bankruptcy or becomes insolvent.

- When the company believes that the cost of collection will exceed the amount of the debt.

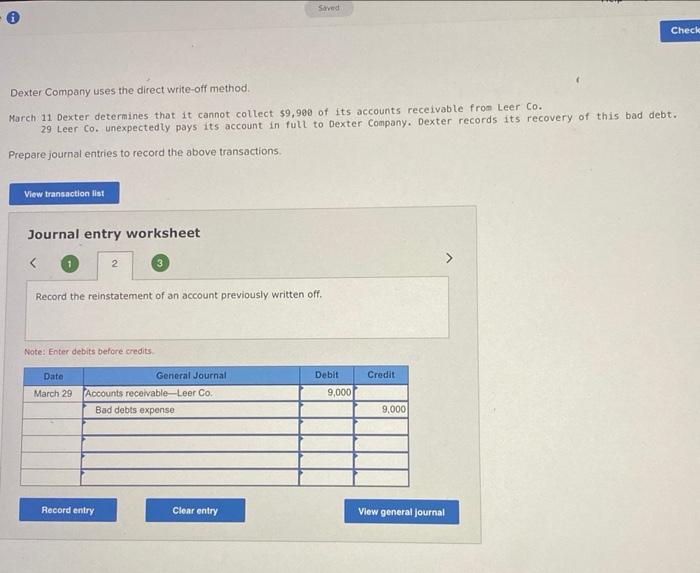

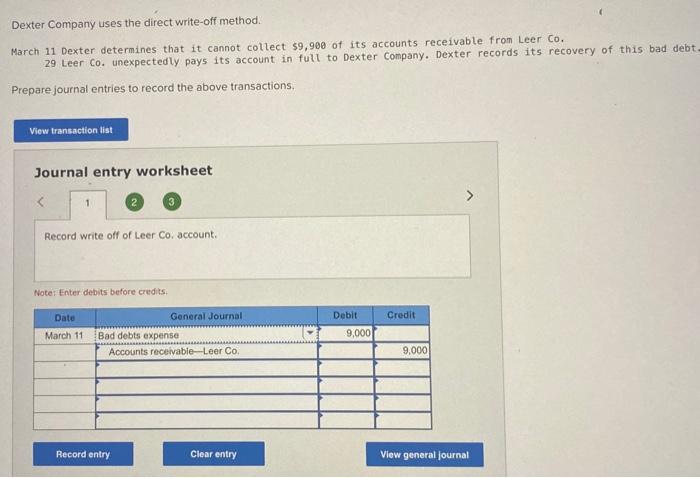

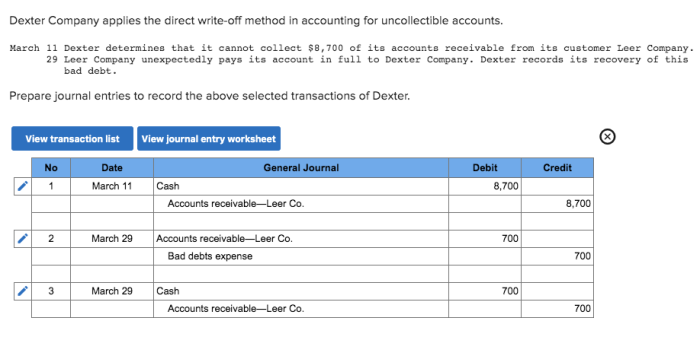

Examples

Examples of transactions that would be recorded using the direct write-off method include:

- A customer owes Dexter Company $1,000 for goods that were purchased on account. The customer has not made any payments on the account for over 90 days and Dexter Company has been unable to collect the debt. Dexter Company would record a direct write-off of $1,000.

- A customer declares bankruptcy and owes Dexter Company $5,000. Dexter Company would record a direct write-off of $5,000.

- Dexter Company incurs $200 in collection costs in an attempt to collect a debt of $1,000. Dexter Company believes that the remaining $800 of the debt is uncollectible. Dexter Company would record a direct write-off of $800.

Top FAQs: Dexter Company Uses The Direct Write-off Method

What are the advantages of using the direct write-off method for Dexter Company?

The direct write-off method offers simplicity, reducing administrative costs and providing a clear-cut approach to managing uncollectible accounts.

What are the disadvantages of using the direct write-off method for Dexter Company?

The direct write-off method may underestimate the allowance for doubtful accounts, leading to potential inaccuracies in financial reporting.